Inheritance is a fundamental aspect of wealth transfer, encompassing the distribution of assets, property, and financial resources from one generation to the next. In this blog, we'll delve into the intricate mechanics of inheritance, exploring how it works, supported by reliable data and sources, and backed by numerical insights.

Part I: Understanding Inheritance

Inheritance is a common practice worldwide, with approximately $68 trillion expected to be passed down from one generation to the next in the United States alone over the next 25 years, as per a report by Wealth-X.

- Testate vs. Intestate: Inheritance can occur in two primary scenarios. Testate inheritance happens when the decedent has a valid will in place, outlining how their assets are to be distributed. Intestate inheritance occurs when there is no will, and state laws dictate asset distribution.

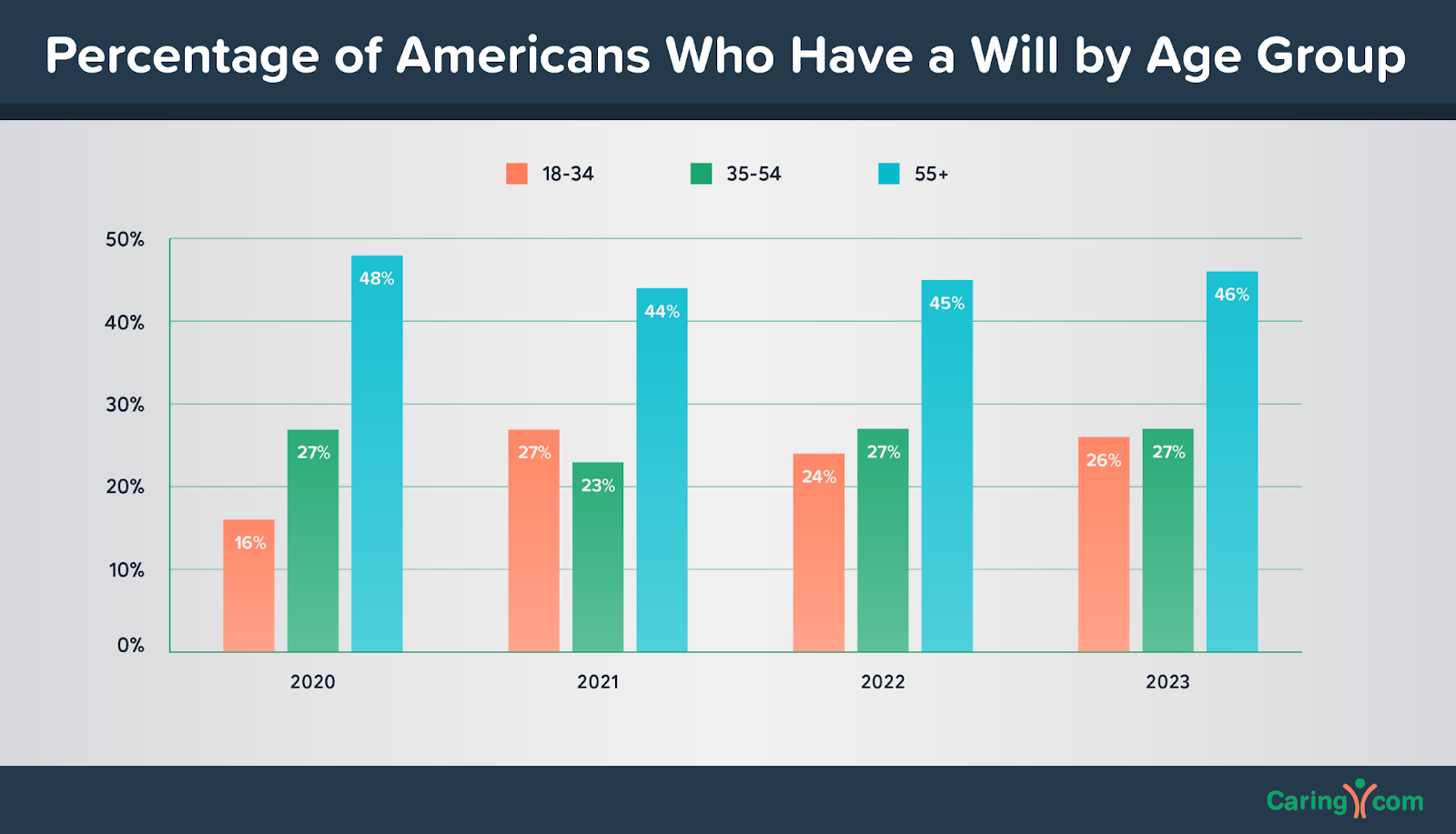

According to a Caring.com survey, only 42% of U.S. adults have estate planning documents, indicating that many may be subject to intestate inheritance laws.

Part II: The Role of Wills

A will is a legal document that outlines the distribution of assets upon a person's death.

A study by LegalZoom found that 25% of Americans without a will said it's because they hadn't gotten around to making one.

- Executor: A will designates an executor, responsible for managing and distributing the estate as per the decedent's wishes.

- Heirs and Beneficiaries: Wills specify who the beneficiaries are and the assets they are entitled to.

Part III: Probate and Non-Probate Assets

In a report by the American Bar Association, it's estimated that probate typically takes six months to a year, but can sometimes extend for years, delaying the distribution of assets.

- Probate: Probate is the legal process of validating a will, settling debts, and distributing assets. It can be a lengthy and expensive process.

- Non-Probate Assets: Some assets, such as life insurance, retirement accounts, and jointly owned property, bypass probate and pass directly to beneficiaries.

Part IV: Taxes and Inheritance

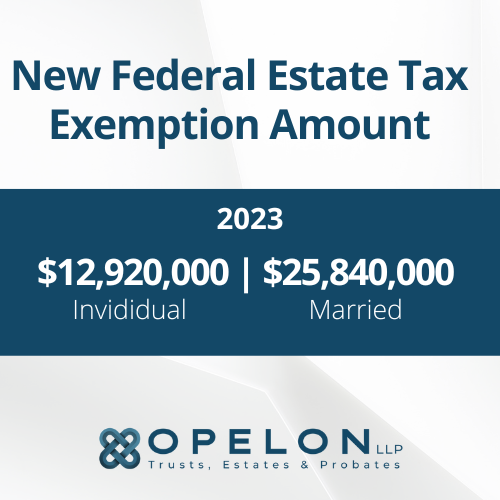

In the United States, the federal estate tax exemption was $12.9 million per individual in 2023, exempting most estates from federal estate taxes.

- Federal and State Estate Taxes: In some countries, estates may be subject to federal and state estate taxes, depending on the value of the assets.

- Inheritance Taxes: Inheritance taxes are levied on the beneficiaries, not the estate. They vary by state and sometimes depend on the relationship between the beneficiary and the decedent.

Part V: Charitable Bequests and Legacy Planning

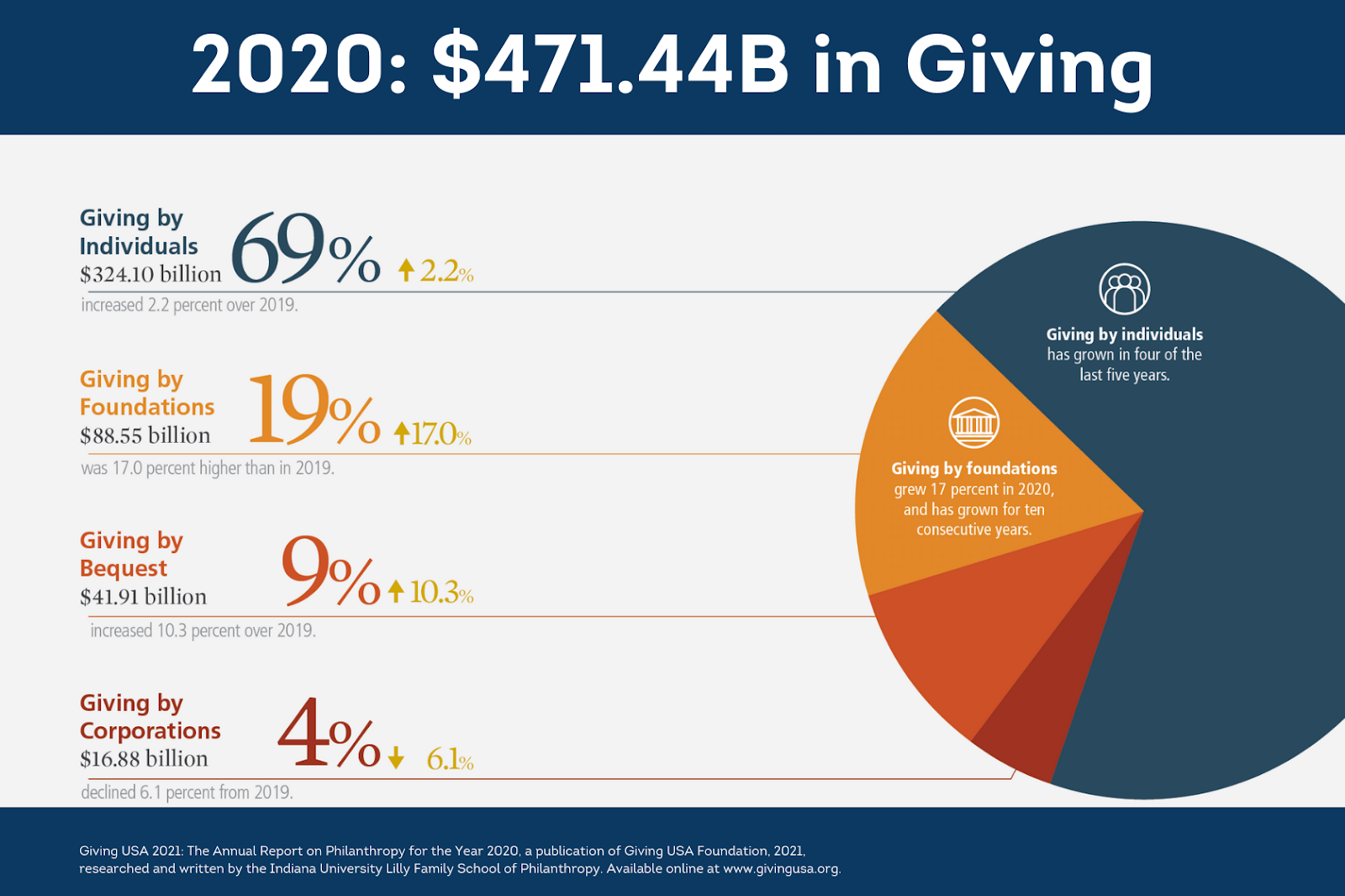

According to Giving USA, charitable bequests in the United States reached $471.44 billion in 2020.

- Charitable Bequests: Many individuals choose to include charitable donations in their wills as a way to leave a legacy.

- Legacy Planning: Legacy planning is a strategic approach to inheritance that incorporates not only financial assets but also personal values and principles.

Understanding the intricate mechanics of inheritance, the role of wills, probate, tax implications, and legacy planning is crucial for anyone involved in the inheritance process. With reliable data and sources as your guide, you can make informed decisions and ensure a smooth transition of assets from one generation to the next, aligning with your values and goals.